City of Frisco/Collin County Small Business Grant Program

Purpose: The City of Frisco is launching the Frisco/Collin Small Business Grant Program (Frisco/Collin SBGP) for businesses physically operating within the Collin County portions of Frisco. The goal of this program is to help the businesses that have been negatively affected and suffered economic hardship due to business closure during the COVID-19 pandemic.

Additional Program Information

– UPDATED Program FAQs 6/29/2020

Funding: $3.1 million of Coronavirus Relief Fund funding (as provided by the CARES Act)

Definition of small business: Business with no more than 100 employees and annual revenue of no more than $15 million.

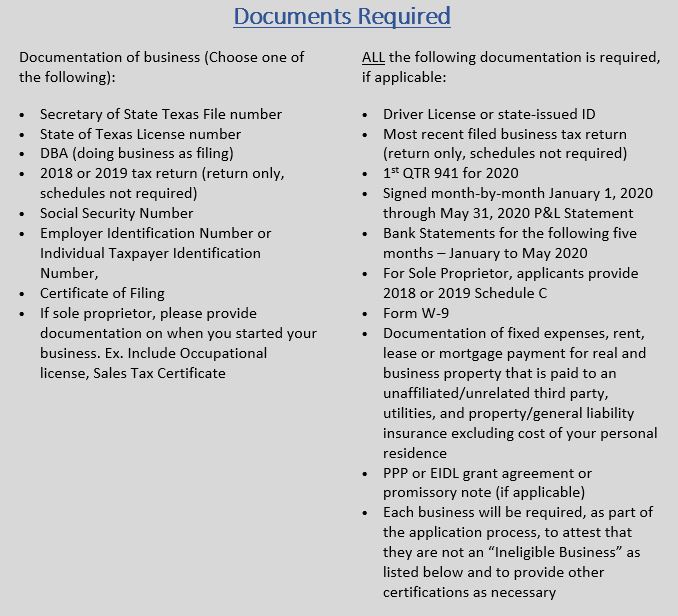

Other eligibility requirements: Business must be a for-profit business with physical operations (Storefront/Office) located in the incorporated boundaries of the City of Frisco that are within Collin County. Business must be current in the payment of county and local taxes with no liens. Business must have been in operation on or before March 1, 2019.

Type of assistance: Grant

Maximum grant amount: $50,000

Maximum grant calculation: 3 months of estimated expenses for payroll and fixed costs from March 1 to May 31, 2020.

Payroll: includes: gross payroll, retirement costs and health insurance costs

Fixed costs: include: rent, lease or mortgage payment for real and business property that is paid to an unaffiliated/unrelated third party, utilities, and property/general liability insurance excluding costs of your personal residence.

Eligible uses of grant funds: Payroll costs for employees or owners draw (sole proprietors/partners); contract labor; supplier payments; rent, lease or interest on mortgage payment for real property used for business purposes, like storefront or warehouse, excluding personal residence; rent, lease or purchase payment for business property (e.g., delivery vehicle; food truck; kitchen equipment; furniture, technology, payment, and communications systems and equipment); insurance (Health, Payroll, Property/General Liability); new or expanded technology applications and Wi-Fi services, utility payments to include municipal utilities (water, sewer, trash) for business properties, excluding personal residence; cost of critical business operations (raw materials, marketing expenses, etc. payments); PPE and sanitation supplies and equipment; interest on other business debt obligations incurred before March 1, 2020, excluding personal residence.

Excluded businesses: Non-profits; non-storefront & home-based businesses; sexually/adult-oriented businesses; lobbying organizations and political organizations subject to Internal Revenue Code 527; gambling Concerns, including casinos, racing operations or other activities whose purpose involves gambling; concerns engaged in illegal activities under federal, state or local laws; a business that is otherwise prohibited by federal or Texas law; a business that is ineligible or precluded to receive federal or State of Texas funding due to federal laws (including but not limited to the CARES Act) or Texas laws; multi-level marketing concerns; governmental/taxing agencies/departments; businesses in default or arrearage on past or current federal or state financing or funding programs; businesses involved or affiliated with personal or corporate indictment, arraignment or conviction of criminal offenses.

Excluded persons: Elected City Officials, City Board Appointed Officials, City Employees and any relation within the second degree by consanguinity or the second degree by affinity to any member of the city council, city boards and commissions, or city employees are not eligible to receive grant funds.

Status of program: The application window has closed.

Email: ntxsmallbiz@ndconline.org

Please identify where your business is located in your email.

Toll Free Phone number: (833) 696-0804. All voicemail messages will be returned within one business day.