Just like ordering takeout or checking in for a flight, getting a business loan has gone digital. This shift puts you—the business owner—in the driver’s seat in an exciting way.

Forget what you’ve seen on Shark Tank—real business lending doesn’t happen in dramatic pitch meetings. Instead, successful loan applications tell a story about your business, and nobody can tell that story better than you. In the past, loan officers would try to capture your business’s story from a brief phone call or meeting, often missing important details. Today’s technology puts you in control and lets you share your story directly with lenders.

Here, we break down how you can use technology to your advantage when applying for a small business loan.

Technology puts you in the driver’s seat

Think about how you order food for a group. You carefully collect everyone’s orders, input them into an app, and make sure everything is just right—doing so at the time that is most convenient for you. Or consider checking in for a flight—you bring your identification documents, tag your own bags, and breeze through security without waiting in long lines.

Business lending is following the same path. When you apply for a loan online, approach the process with the mindset that you’re not just filling out forms—you’re actively taking control of the process and presenting your business’s story in the best possible light. When you are organized and ready to provide the information that’s asked of you, you’ll get to the closing table more quickly.

Getting ready to check in

Remember the airport analogy? When you fly, your journey is smoother if you prepare in advance and are ready with exactly what you need to get to the gate: your boarding pass, tagged luggage, ID, empty water bottles, and more.

It’s the same when applying for a small business loan. Knowing what you’ll need to get to the closing table and preparing in advance will dramatically speed up the process for you and reduce the potential for frustration. Here’s what you typically need to have ready to apply:

- Answers to the following key questions:

- Business background questions such as length of time in business, ownership structure, and a description of your good or service.

- How much money do you need?

- What will you use the money for?

- How will this help your business grow?

- What makes your business special compared to competitors?

- How do you plan to pay back the loan?

- Documents to gather

- Business and personal tax returns.

- Business debt schedule (list of existing loans, including the terms of the loans and provider of the loans).

- Year-to-date financial statements for your business.

- Quotes or invoices for items you plan to buy with the loan.

- Personal financial statement (PFS) that details assets you own, personally, and the corresponding liabilities, as applicable.

- Corporate organization and governance documents.

In the mind of a lender, the loan approval process starts the moment you begin your application. Make a strong first impression by having this information ready in advance, showing confidence in your business plan, and being ready to provide timely responses to follow-up questions and requests for information.

Benefits of going digital

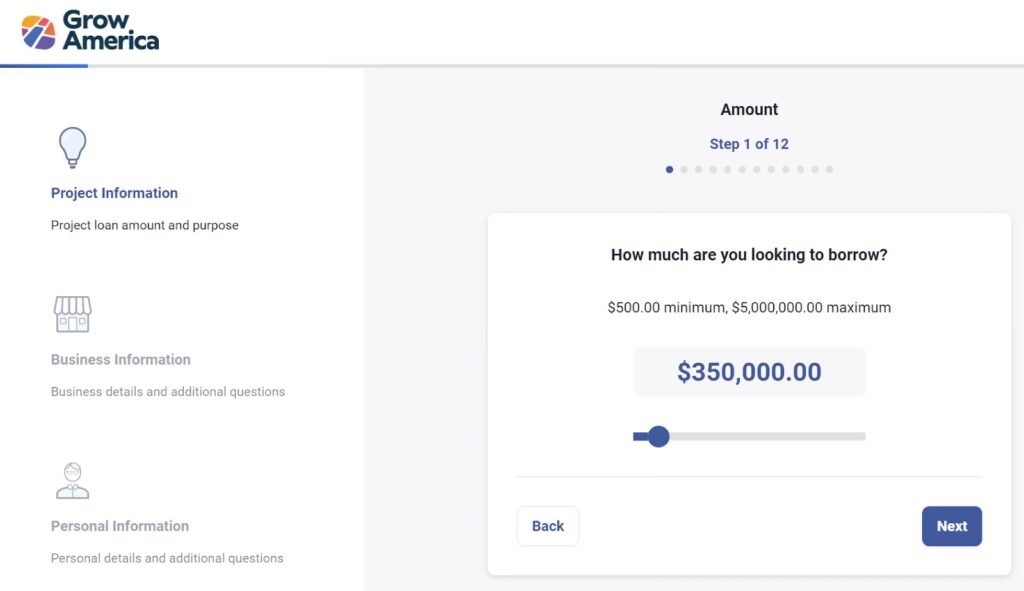

Many lenders, including Grow America, use technology to make answering these questions and providing these documents easy. It’s in your best interest to use this technology to take control of the process and get to the finish line quicker. Modern lending platforms offer several advantages:

- Ability to work on your application whenever it’s convenient, even nights and weekends.

- You can view exactly what documents you still need to submit.

- Tracking features that allow you to see your application’s progress in real-time.

- You can keep all your documents organized in one place.

- The back-and-forth of endless emails is drastically streamlined, plus sharing sensitive information is more secure when done over a lending platform.

At Grow America, while technology makes the process smoother, you’re not alone. We combine easy-to-use online tools with human support. Think of it like using an airline’s check-in kiosk— there’s always someone nearby if you need help, but you can move faster by handling the basics yourself.

Moving forward with confidence

Today’s digital loan applications put you in control. You get to tell your business’s story, share important details, and move through the process at your own pace. With the right preparation and modern technology on your side, you’re better equipped than ever to secure the funding your business needs to grow.