Federal Award Identification Number (FAIN): SSBCI-21031-0048

Intent

Grow America is requesting proposals from qualified organizations to partner with Grow America as a Contractor to assist in managing a revenue-based financing program in Washington State’s SSBCI Program.

Key Dates

Solicitation Issuance Date: Wednesday, March 13, 2024

Written Questions Deadline Date: Friday, March 22, 2024

Proposal Submission Deadline: Thursday, March 28, 2024, no later than 2 pm (PT)

Questions should be sent to: Mary Louk mlouk@growamerica.org

Background

Grow America (formerly the National Development Council) is the nation’s oldest nonprofit community development organization, a CDFI and training/technical assistance provider in the areas of affordable housing and economic development to nonprofit and public sector entities. Throughout the pandemic, Grow America has served as third party administrator and efficiently deployed over $632 million in disaster recovery programs across the U.S. Grow America has been an innovator in designing and developing programs and providing capital to economically underserved communities.

On March 11, 2021, President Biden signed The American Rescue Plan Act, which provides for the reauthorization and expansion of the State Small Business Credit Initiative (SSBCI), administered by the U.S Department of Treasury (Treasury). Treasury has appointed the Washington State Department of Commerce (Commerce) as the implementing entity to execute Washington’s approved SSBCI plan.

The purpose of Treasury’s SSBCI program is to strengthen state programs that support private financing to small businesses where it provides funding to state small business lending and investment programs. The goals of the state’s SSBCI programs are to address the capital needs of the smallest businesses and non-profit organizations of Washington State, with a focus on under-resourced and under-banked communities.

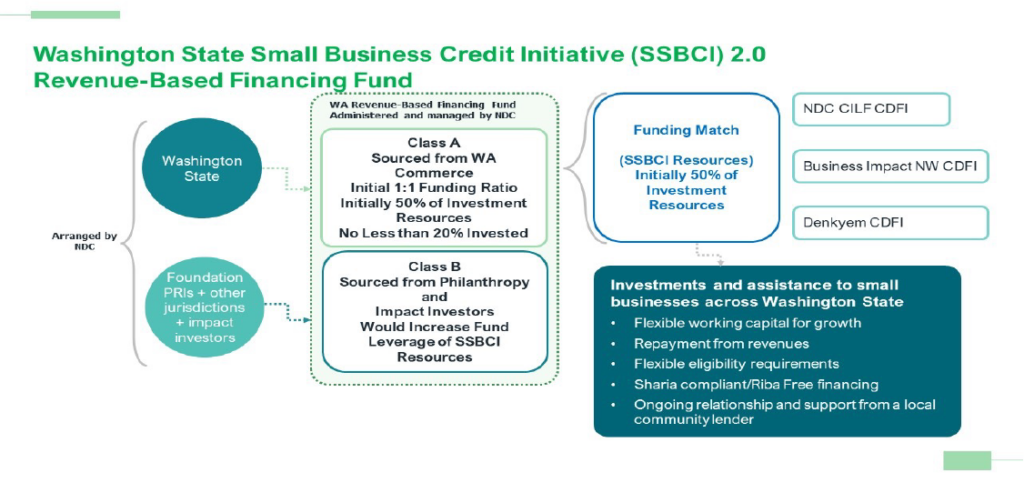

As a result of RFP No. SSBCI-2022, Grow America will serve as the statewide administrator of Washington’s Revenue Based Financing Fund (RBF). The program intends to meet the needs of Very Small Businesses (VSBs) and SEDI-owned businesses historically excluded from traditional debt and investment capital markets.

Program Overview

Grow America, along with CDFI implementation partners, will make revenue-based investments in small business across Washington State. The RBF will provide capital to the delivery partners so that they can provide RBF investments. The Fund would provide matching SSBCI capital to partners via an investment agreement that leverages their capital and confirms reporting requirements on their part for SSBCI compliance.

By participating in investments, the RBF can ensure there is adequate private lender risk as a condition for SSBCI funding as well as confirm compliance with program direction and requirements. On the front end of each transaction, the investors will document the baseline data on firm financial condition and will assess ability to secure conventional debt in current condition. This baseline information will set the stage for the downstream annual evaluation needed to determine when additional capital is attracted as a “cause and result” of the investment of SSBCI dollars.

The Fund will initially offer three RBF products:

- Micro business RBF investments; and

- Business growth RBF investments; and

- Sharia Compliant/Riba Free RBF investments.

RBF Program Parameters

Scope of Services

Grow America is seeking proposals from qualified organizations to provide an electronic platform for business application submittal, connections to lending partners and to provide document retention. A key requirement for any proposed platform will be to facilitate documentation and reporting required by the Washington Department of Commerce and the U.S. Treasury, as outlined below:

Targeted Borrowers and Criteria

A portion of all program funding is targeted towards Very Small Businesses (VSB) and businesses owned by Socially and Economically Disadvantaged Individuals (SEDI).

SEDI-owned businesses are defined as follows:

(1) business enterprises that certify that they are owned and controlled by individuals who have had their access to credit on reasonable terms diminished as compared to others in comparable economic circumstances, due to their:

- membership of a group that has been subjected to racial or ethnic prejudice or cultural bias within American society;

- gender;

- veteran status;

- limited English proficiency;

- disability;

- long-term residence in an environment isolated from the mainstream of American society;

- membership of a federally or state-recognized Indian Tribe;

- long-term residence in a rural community;

- residence in a U.S. territory;

- residence in a community undergoing economic transitions (including communities impacted by the shift towards a net-zero economy or deindustrialization); or

membership of an underserved community (see Executive Order 13985, under which “underserved communities” are populations sharing a particular characteristic, as well as geographic communities, that have been systematically denied a full opportunity to participate in aspects of economic, social, and civic life, as exemplified by the list in the definition of “equity,” and “equity” is consistent and systematic fair, just, and impartial treatment of all individuals, including individuals who belong to underserved communities that have been denied such treatment, such as Black, Latino, and Indigenous and Native American persons, Asian Americans and Pacific Islanders and other persons of color; members of religious minorities; lesbian, gay, bisexual, transgender, and queer (LGBTQ+) persons; persons with disabilities; persons who live in rural areas; and persons otherwise adversely affected by persistent poverty or inequality);

A broad list of possible data points is provided as an exhibit to this document.

Qualifications

Grow America is seeking proposals from reputable community organizations with:

- Experience in the development and implementation of similar electronic platforms for business lending programs.

- A comprehensive understanding of the regulatory requirements of the SSBCI program as well as required Treasury reporting.

- Experience is supporting similar business lending funds in Washington State (preferred) or other locales.

- The ability to work with lending partners on their specific requirements on the platform.

- Experience with developing and deploying similar networking programs.

Proposal Requirements

Proposals should be no longer than ten double-spaced pages written in 12-point font, excluding bios, resumes and disclosures.

Proposals should include the following:

- COVER PAGE with firm information to include:

a. Legal Name and DBA (if applicable)

b. Physical Address

c. Mailing Address

d. Phone Number

e. Website

f. Year Established

g. Employer Identification Number

h. Unique Entity Identifier

i. Mission Statement

j. Contract information for authorized contract signer

k. Proposal Contact Information - EXECUTIVE SUMMARY with a concise statement of the Respondent’s understanding of the RFQ and how the organization is best suited to provide these services.

- QUALIFICATIONS AND EXPERIENCE should include the following:

a. Describe background and related experience in demonstrating ability to provide required services to support Grow America deploy SSBCI funds.

b. List and describe at least two successfully completed similar projects.

c. Provide Project Team chart with names and the qualifications and experience of staff who will be assigned to this project. Please attach bios and resumes of project team members as Exhibit A.

d. Provide three professional references who can attest to and have knowledge of your organization’s work. For each reference, the Respondent should provide the entity name, contact person, title, telephone number, email address, and a brief description of your engagement with the reference.

e. If you anticipate engaging another vendor/organization to assist with any portion of the project, please explain their role in detail.

Conflict of Interest

Respondent shall disclose as Exhibit B any conflict of interest under this solicitation. A conflict of interest occurs when an individual’s personal interests (family, friendships, financial, or social factors) compromise the impartiality of a procurement process and create an unfair competitive advantage.

Respondent represents that it:

- Is not related to by blood or marriage any Grow America Board Member or employee;

- Has not provided a gift or payoff to a Grow America Board Member or employee or their relative or business entity;

- Has not retained any person to solicit or secure this contract upon an agreement or understanding for a commission, percentage, or brokerage or contingent fee;

- Has not knowingly influenced a Grow America Board Member or employee.

Failure to disclose a conflict of interest or for violation of these provisions, Grow America shall have the right to terminate this solicitation and any future contract negotiations.

Submission Requirements

Respondent shall submit a complete proposal electronically (via email) in one Adobe PDF file. Proposals should be no longer than ten double-spaced pages written in 12-point font, excluding bios, resumes and disclosures. Proposals should include concise responses to the specifications outlined in “Proposal Requirements” and should be organized/bookmarked as outlined below:

- Cover Page

- Executive Summary

- Qualifications and Experience

- Exhibit A – Bios and Resumes

- Exhibit B – Conflict of Interest Disclosure (if applicable)

- Exhibit C – Suggested Budget

Proposals must be emailed to mlouk@growamerica.org by the proposal submission deadline at 2pm (PST) on Thursday, March 28, 2024.

Proposal Contact

Mary Louk, Program Director E-mail: mlouk@growamerica.org

Appendix A: Possible Data Requirements

The SSBCI has a variety of reporting requirements for regulatory reporting as well as basic program development needs. The selected contractor will work with Grow America’s Fund Manager to finalize reporting requirements to the Washington State Department of Commerce and the U.S. Treasury.

* As provided by an updated from time to time by Commerce, consistent with Treasury’s SSBCI Reporting Guidelines: https://home.treasury.gov/system/files/136/SSBCI-Reporting-Guidance.pdf

Required for the Contract Entity to collect the following information:

- Provider Data

a. Approved Program Name

b. Provider

c. Provider EIN

d. Provider Regulatory ID

e. Other Provider ID

f. Provider Type

g. Other Provider Type

h. Minority Depository Institution

i. Fund as Source of Private Capital

j. Provider as Source of Private Capital

k. Target Fund Size

l. Incubation and Early-Stage Investment Call Option

m. Allocated Funds Expended for Costs of Program Services - Loan and Investment Info

a. Unique Transaction ID

b. Provider

c. Approved Program Name

d. Business Name

e. Business EIN

f. Business Street Address

g. Business City

h. Business State

i. Business Zip Code

j. NAICS Code

k. Year Business Opened

l. Form of Business Organization

m. Other Type of Business Receiving SSBCI Funds

n. Tribal Government Program Transaction Type

o. Primary Transaction Source of Private Capital

p. Secondary Transaction Source of Private Capital

q. Primary Purpose of the Loan or Investment

r. Purpose of the Loan or Investment-Other

s. Secondary Purpose of the Loan or Investment

t. Secondary Purpose or the Loan or Investment-Other

u. Climate-aligned Investment

v. Energy-or Climate-Impacted Communities

w. Disbursement Date

x. Loan or Investment Transaction Amount

y. Allocated Funds Expended or Set Aside for Guarantees or Collateral Support Obligations

z. Recycled Funds Expended or Set Aside for Guarantees or Collateral Support Obligations

aa. Additional Government Funds

bb. Concurrent Private Financing

cc. Business Revenue

dd. Business Net Income

ee. Full-Time Equivalent Employees

ff. Expected Jobs Created

gg. Expected Jobs Retained

hh. Self-certified SEDI Owned and Controlled in CDFI Investment Area

ii. Self-certified SEDI Future Location in CDFI Investment Area

jj. SEDI Status by Business Address in CDFI Investment Area

kk. Self-certified SEDI Demographics-Related Business Status

ll. Minority-Owned or Controlled Business

mm. Woman-Owned or Controlled Business Status

nn. Veteran-Owned or Controlled Business Status

oo. Race of Principal Owners

pp. Ethnicity of Principal Owners

qq. Middle Eastern or North African Ancestry of Principal Owners

rr. Gender of Principal Owners

ss. Gender of Principal Owners-Self-Identification

tt. Sexual Orientation of Principal Owners

uu. Veteran Status of Principal Owners - Transaction Terms-Credit

a. Unique Transaction ID

b. Loan Type

c. Other Loan Type

d. Loan Term

e. Loan APR

f. Interest Rate Variability

g. Other Repayment Terms

h. Maximum Interest Rate

i. Total Origination Charges - Transaction Terms-Equity

a. Unique Transaction ID

b. Stage of Investment

c. Security Type

d. Other Security Offered

e. SSBCI Ownership Percentage

f. Conversion Discount

g. Valuation Cap

h. Type of Valuation Cap - Loan-Investment Performance

a. Unique Transaction ID

b. Subsequent Private Financing

c. SSBCI Funds Lost

d. Equity Investment Gains - Borrower-Investee Data

a. Business Name

b. Business EIN

c. Business Revenue

d. Business Net Income

e. Year of Reported Business Revenue and/or Net Income

f. Gender of Principal Owners-Self-Identification

g. Sexual Orientation of Principal Owners

h. Veteran Status of Principal Owners - Transaction Terms-Credit

a. Unique Transaction ID

b. Loan Type

c. Other Loan Type

d. Loan Term

e. Loan APR

f. Interest Rate Variability

g. Other Repayment Terms

h. Maximum Interest Rate

i. Total Origination Charges - Transaction Terms-Equity

a. Unique Transaction ID

b. Stage of Investment

c. Security Type

d. Other Security Offered

e. SSBCI Ownership Percentage

f. Conversion Discount

g. Valuation Cap

h. Type of Valuation Cap - Loan-Investment Performance

a. Unique Transaction ID

b. Subsequent Private Financing

c. SSBCI Funds Lost

d. Equity Investment Gains